The problem

Patients, societies and governments demand medical technologies that successfully reduce the burden of disease. Companies’ investment decisions, however, are usually based on profitability and growth potential, which do not always translate into successful patient outcomes in areas of highest need for society.1a, 1b

We have identified a major gap in the current healthcare funding model: the lack of sustainable investment incentives for obtaining positive patient outcomes.

Our solution

We propose the Patient Outcome Funding (POF) model as an innovative and sustainable funding mechanism for medical/healthcare technologies that can address the gap just described.

Our solution builds on an existing framework, namely Social Impact Bonds (SIBs).2a SIBs are a set of contracts whereby investors offer financing with the aim of achieving a social outcome that is of interest to a public body. Successful instances of SIBs can be found in the UK, Australia and the United States. One example is a SIB that funded a support service for offenders leaving prisons in the United Kingdom: the SIB led to re-conviction rates falling by 8.4% compared to the national baseline after 12 months.2b Most SIBs are focused on welfare; very few are approaching healthcare-related areas. 2c

In principle, our proposed POF model is an expansion and adaptation of the SIB framework to be applied to the global healthcare landscape, via the development of bespoke patient outcome-based metrics.2d

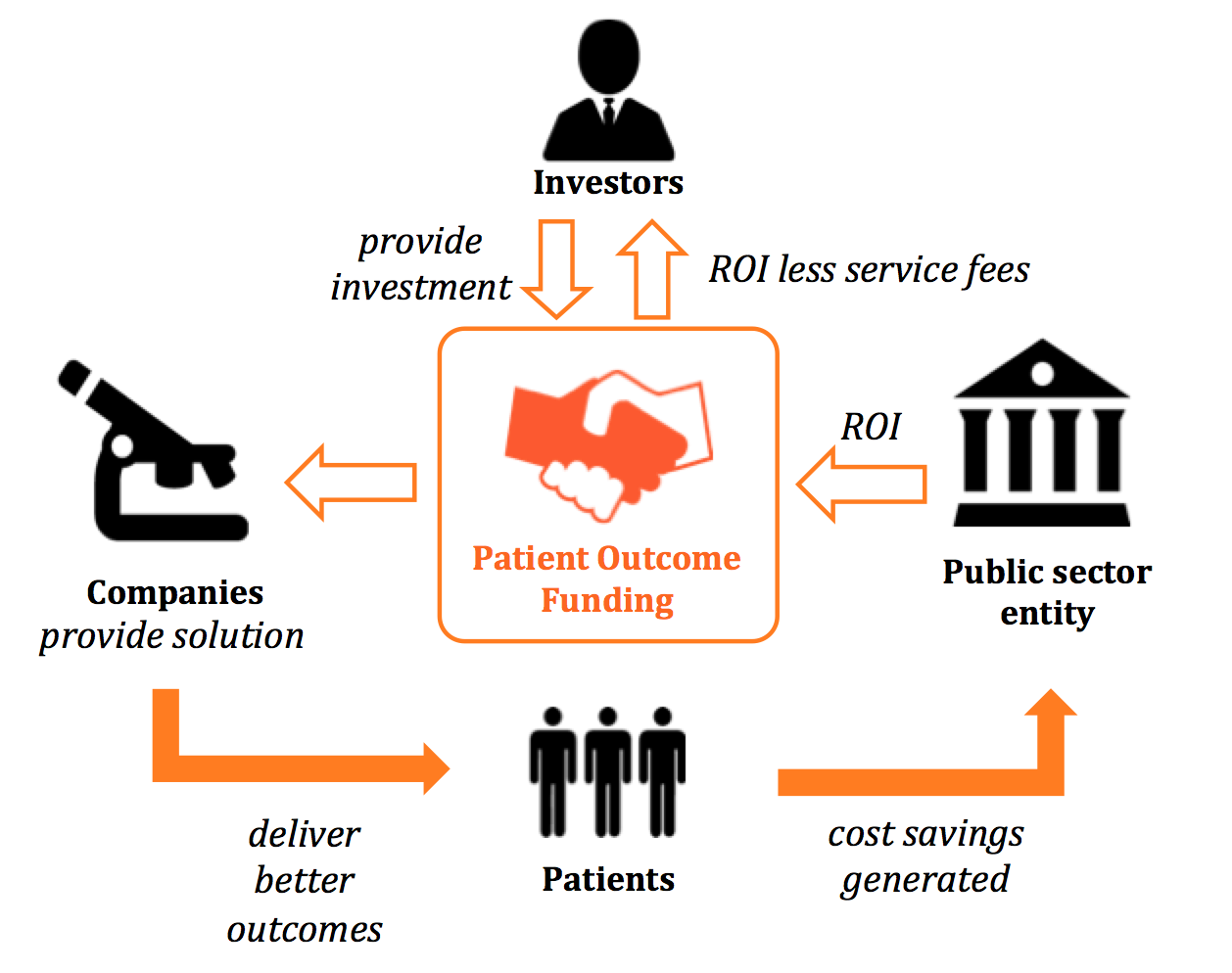

Three parties are to be involved in the POF model:

i. a public sector entity interested in obtaining improved patient outcomes

ii. private and institutional investors

iii. companies with the potential of delivering impactful solutions in public health

As shown in Figure 1, investors provide upfront investment to the companies, which in turn will deliver interventions aimed at achieving positive patient outcomes. If the promised outcome is reached, the public sector entity will benefit from cost savings and will therefore be able to repay investor’s initial investment. The metrics of success and the timeframe will be agreed between investors and the public sector, according to the disease area. For instance, reduced number of hospitalisations will alleviate the burden on the public healthcare system, and the resulting savings will translate into the investors’ return on investment.

Figure 1 - Flow of money and the creation of social benefits from the Patient Outcome Funding Model

Business rationale

Governments, but also the society as a whole, have a direct economic interest in impactful patient outcomes. For example, the outbreak of SARS was estimated to result in a 2% GDP loss in Asian economies,3a while in South Africa HIV/AIDS is expected to depress GDP by as much as 17% over the next decade.3b

The complex landscape in the healthcare industry, exacerbated with budgetary or bureaucratic limitations, often frustrates the public sector’s efforts to intervene in a way that improves patient outcomes; for instance, in the US, Obamacare has resulted in an increase of approximately 30% of insured lives, but is widely criticised for its inherent inefficiencies.3c

In addition, available investment money is not always channeled towards disease areas with the largest potential impact. When comparing investment versus burden of disease, areas with the highest Global Disease Burden such as infectious diseases and HIV/AIDS remain significantly underfunded, leading to a lack of positive patient outcomes for society as a whole.1a

Although the experience with Social Impact Bond type investments is still in early days, Venture Funds and independent analysis have shown returns on investments of 5% up to 20%.3d

Proposed approach and implementation

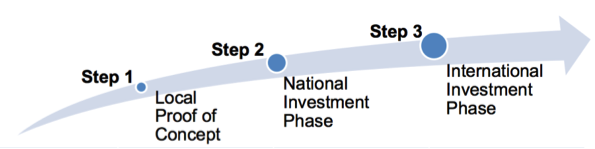

To implement the POF model, we follow a three-step approach, as shown in Figure 2. We will start with an existing, validated model and gradually expand the scope to involve countries that are suffering from a proportionally large burden of disease and have relatively large economic interest for public sector entities to engage in investments.

Figure 2 – Step-wise approach to the Patient Outcome Fund

In the first phase (Step 1, Local Proof of Concept), we will engage public health bodies in the UK by leveraging the existing framework of SIBs, as described previously. In this phase, we will focus on one specific disease – drug resistant tuberculosis (DR-TB). The cost of treating DR-TB in the UK is estimated at £50k-70k per patient.4a

Once the validity of the model is proven, we plan to expand the UK-based fund to invest in HIV-patient outcomes in South Africa (Step 2, National Investment Phase). HIV is currently expected to cause a significant GDP reduction, and the UK’s interest in South Africa’s economy is reflected by the high ongoing volume of trade between the two countries.4b

Finally (Step 3, International Investment Phase), we envisage the expansion of the POF model to bring larger public sector entities to invest in countries with large economic interests where patient outcomes could have the greatest positive impact, for instance expanding to other infectious and neglected diseases areas.4b

As a team, we want to start the POF by engaging investors, public sector entities and companies to implement Step 1. As a long-term goal, once Step 1 has proven that the model is feasible, Steps 2 and 3 could be then carefully executed. Ultimately, our ambition is that this model will represent an attractive alternative for funneling healthcare funding globally – which in turn will allow for tackling of healthcare areas that are currently neglected but have high socio-economic impact and for which no other sustainable funding mechanism currently exists.

References

- Financing of U.S. Biomedical Research and New Drug Approvals across Therapeutic Areas, E. Ray Dorsey et al. (2009)

- Cicero report, 2016

1b

- Social Finance - A new way to invest in better healthcare (2011)

- McKinsey Social Impact Bonds Report: From Potential to Action: Bringing Social Impact Bonds to the US (2012)

2b

2c

- Social Finance - healthcare

- Stefanie Tan, Alec Fraser, Chris Giacomantonio, Kristy Kruithof, Megan Sim, Mylene Lagarde, Emma Disley, Jennifer Rubin, Nicholas Mays “An evaluation of Social Impact Bonds in Health and Social Care.”, Policy Innovation Research Unit (PIRU), Department of Health Services Research and Policy London School of Hygiene and Tropical Medicine, and RAND Europe (2015)

2d

- POF team analysis, to request full detail please contact us

3b

3c

4b

- VizHub/WHO

- Population and income data: CIA Factbook 2015 (2015)

- UK Trade information: UK Trade Statistics Nov 2015 (2015)

- EU Trade information: European Commission, Directorate General for Trade (2015)

4c